BaaS Solution

We offer a full suite of BaaS digital banking tools that allow our partners to launch fully branded online and mobile payment platforms under their own name.

Pick the solution to fit your needs:

API Solution

Your Website:

New users register and apply for services from within your front-end

Existing users access the service from their usual client area in your front-end

API: Data received and processed at your side is transmitted to us.

Your internal tools: Receipt of applicants’ data, payment instructions or account enquiries takes place within your own platform

API: Data processed at our side

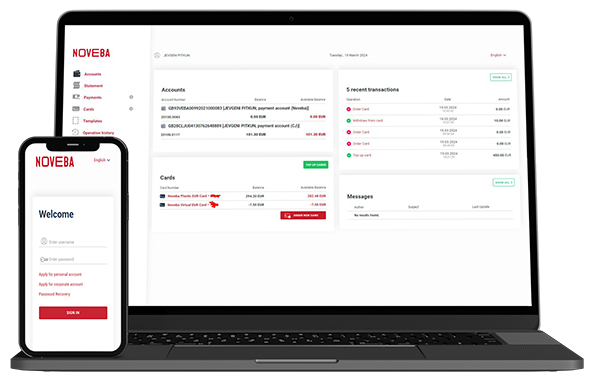

White Label Solution

Your Website: Clients’ journey begins from your own domain and website.

Internal Processing: Clients access "open a new account" or “log in” links that are on your domain

Noveba platform: After successful registration and verification client becomes a user of Noveba e-banking platform tailored with your brand’s styling and domain

Integration with our software: Client-facing e-banking portal is visually aligned with your styling

Developers and Software Providers

BaaS offer APIs (Application Programming Interfaces) that developers and software providers can use to build and integrate financial services into their applications and systems.

Businesses and Corporations

BaaS can be employed by businesses of various sizes to embed financial services into their offerings. This is especially beneficial for companies that want to streamline payments, manage expenses, or provide access to payment and transactional services to their customers

E-commerce platforms

Companies operating in the e-commerce sector can integrate BaaS to facilitate seamless payment processing, manage transactions, and provide customers with a better online shopping experience.

Banks and Financial Institutions

Traditional banks and financial institutions can leverage BaaS to modernise their infrastructure, accelerate digital transformation, and enhance the efficiency of their services.

Start-ups and Entrepreneurs

BaaS is particularly advantageous for start-ups and entrepreneurs who want to launch financial products without the complexities of building an entire banking infrastructure. It allows them to enter the market quickly and cost-effectively.

Always at your service

For issues or questions, check out our FAQ page or contact us via phone, email or contact form.